January does something magical in Baldwin County: it turns “someday” decisions into “let’s do this” plans.

Property owners are staring at a fresh calendar (and last year’s maintenance surprises). Investors are asking, “Is now a smart time to buy?” And Mardi Gras visitors are getting attached to Fairhope sunsets and Daphne charm… and quietly Googling rentals on the ride home.

So let’s make January useful. Not fluffy. Not “new year, new you.” More like: new year, better choices..

January is planning season for rental owners (and that’s a good thing)

If you own a rental—single-family, multi-family, or even a small portfolio—January is when your property either:

- starts the year calmly,

or - starts the year by setting your inbox on fire.

This is the month owners typically notice the “slow leaks” that quietly drain ROI:

- Long vacancy gaps between tenants

- Rent that’s slightly under market (death by a thousand dollars)

- Deferred maintenance turning into emergency maintenance

- Resident issues that never fully got handled

- Vendors that are… let’s call them “creative with timelines”

The January advantage: you can fix systems before peak moving season ramps up in spring and summer.

Is January a good time to buy an investment property in Baldwin County?

It can be—if you’re buying strategically instead of emotionally (pretty porches are not a business plan, no matter how charming).

Why January can work in your favor

- Less competition than spring: fewer buyers shopping aggressively can mean more negotiating room.

- Serious sellers: some owners listed late in the year and are ready to make a deal.

- Cleaner underwriting: you can review last year’s rent history, expenses, insurance changes, and real numbers—not vibes.

- Time to stabilize before peak season: buy now, improve operations, and be positioned for spring/summer demand.

When January may not be the best move

- If you’re rushing to “use new year motivation” as a financial strategy

- If you don’t have reserves for repairs, insurance shifts, or vacancy

- If you’re not sure whether the property will perform as a long-term rental (or needs a different approach)

Smart investor move: before you buy, get a rental performance reality check—market rent range, likely turn costs, maintenance risk, and what it would take to attract better residents.

Mardi Gras doesn’t just bring beads… it brings future residents

Baldwin County during Mardi Gras is basically a live-action lifestyle demo.

Visitors come for parades and parties—and leave thinking:

- “Wait… people actually live like this?”

- “Fairhope feels like a movie set.”

- “Daphne is way closer to everything than I expected.”

- “Foley is convenient and I didn’t hate traffic once.” (a rare southern miracle)

Here’s what happens next:

- They go home

- They start browsing homes and rentals “just for fun”

- Then they realize relocating is… very real

- Many choose to rent first, learn the area, and buy later

That “rent first” phase is a huge opportunity for rental owners—if your property is marketed and managed correctly.

Why “rent first” is a smart relocation strategy (and why rental owners should pay attention)

A lot of relocation buyers don’t buy immediately. They rent because they want to:

- test neighborhoods (Fairhope vs Daphne vs Spanish Fort vs Foley is a real debate)

- understand commute patterns and school zones

- get through one full season here (hello, humidity and hurricane prep)

- decide if they want waterfront, walkability, acreage… or “close to Target” convenience

Translation for owners: relocation renters tend to be motivated, organized, and willing to pay for the right home—especially when the process is smooth.

But they also expect:

- fast responses

- clean, professional leasing

- clear policies

- a home that’s actually move-in ready (not “mostly”)

Own a rental and thinking of selling this year? January can be your moment

Some owners start January with a blunt realization:

“I don’t want to do this another year.”

If that’s you, you’re not failing. You’re making a strategic decision.

January can be a strong time to evaluate:

- whether the rental still fits your financial goals

- whether the property would perform better after operational fixes

- whether listing now (before more spring inventory) makes sense

- whether you’d rather exchange into a different type of investment

Key idea: you don’t have to choose between “keep suffering” and “sell tomorrow.”

Sometimes the best answer is: stabilize, optimize, then decide.

If selling is part of your plan, our sister company Ashurst Niemeyer Real Estate can help. Give us a call and we will connect you with one of their expert advisors 251.210.1664. (Here’s a good read about selling in January.)

New Year checklist for rental owners (fast wins that protect ROI)

Here’s your “make January worth it” list:

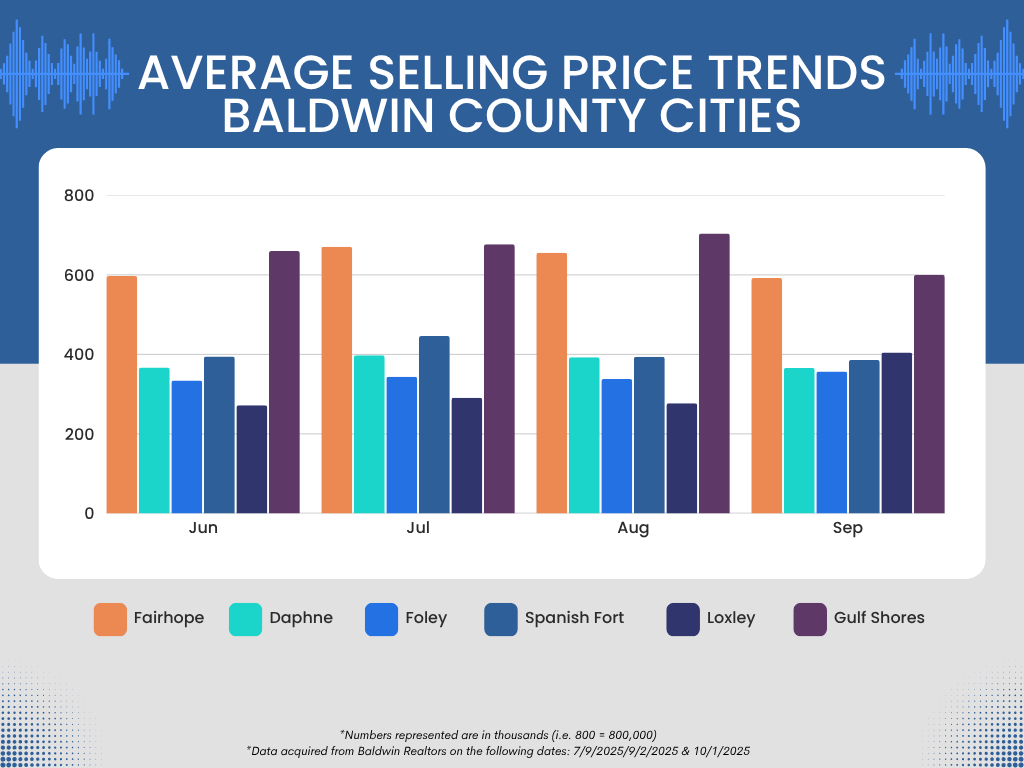

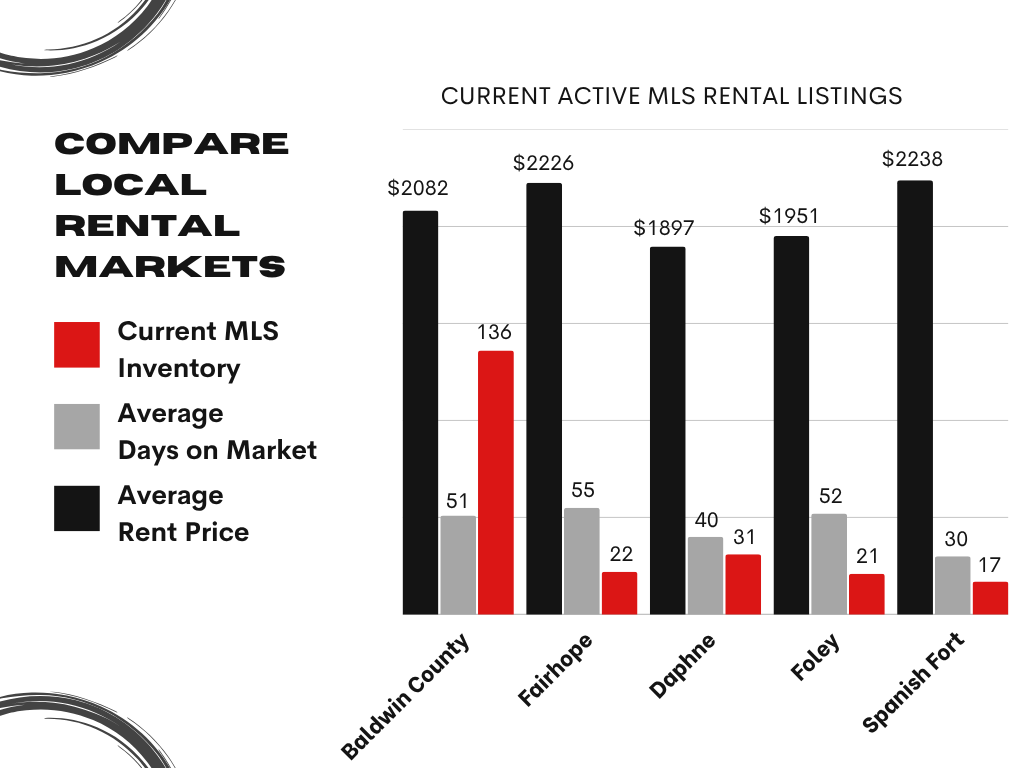

- Review your rent vs market rent (even a small gap adds up fast)

- Schedule preventative maintenance (HVAC, gutters, leaks, safety checks)

- Audit your lease renewal timeline so you’re not surprised by turnover

- Check your insurance requirements and compliance items

- Upgrade listing photos (dark iPhone hallway pics = longer vacancy, every time)

- Tighten screening + lease enforcement so you stop attracting chaos

- Create a clear repair approval policy so maintenance doesn’t become a daily negotiation

If reading that list made you tired, congratulations: you’re a normal human.

That’s exactly why property management exists.

What great property management changes (besides your blood pressure)

A solid management team doesn’t just “collect rent.” They protect and grow the value of the asset.

That looks like:

- pricing that tracks the real market (not outdated guesses)

- shorter vacancies through better marketing + faster leasing

- consistent resident communication (so problems don’t snowball)

- proactive maintenance that reduces expensive emergencies

- financial reporting you can actually use to make decisions

- local vendor relationships that get things done without drama

And if you’re also thinking about investing or selling? Even better—because you can make those moves with real data, not anecdotes.

Ready to make January your most profitable month—not your most stressful one?

If you’re a Baldwin County rental owner and you want:

- less vacancy

- better residents

- stronger ROI

- and fewer 10:47 PM maintenance texts

…then it’s time for a smarter system.

Get a free rental performance review (rent range + vacancy risks + ROI leaks) Call Level Property Management Group today 251.210.1664

FAQ: January, investing, rental properties, and Mardi Gras relocation

Is January really a good time to invest in Baldwin County rentals?

It can be. January often has less buyer competition than spring and gives you time to stabilize the property before peak moving season. The key is running the numbers with realistic rent, repairs, and reserves.

Do Mardi Gras visitors actually relocate here?

Yes—Mardi Gras introduces people to the lifestyle and towns across Baldwin County. Many start by renting first, then buy after they learn the area.

Is renting first better than buying right away when relocating?

Often, yes. Renting first helps people choose the right town, neighborhood, and lifestyle fit—especially if they’re new to the area.

What’s the biggest mistake rental owners make in January?

Waiting until spring to “deal with it.” January is when you can fix pricing, maintenance, marketing, and systems before the busiest season starts.

How do I know if I should keep, sell, or reinvest?

You need a quick performance snapshot: rent vs market, vacancy risk, repair outlook, and ROI. Once you see that, the decision usually gets clearer fast.