Owning commercial property can feel a bit like spinning plates — while juggling flaming torches — on a windy day. Between tenants, maintenance, leases, and spreadsheets that multiply overnight, it’s easy to see why there are so many questions.

That’s where we come in. At Level Property Management Group, we believe managing commercial properties shouldn’t require caffeine and crisis management skills. It should feel… level. So, let’s tackle the seven questions we hear most often — with straight answers, a little local wisdom, and maybe a grin or two.

1. How does residential management differ from commercial — and why do you need a specialist?

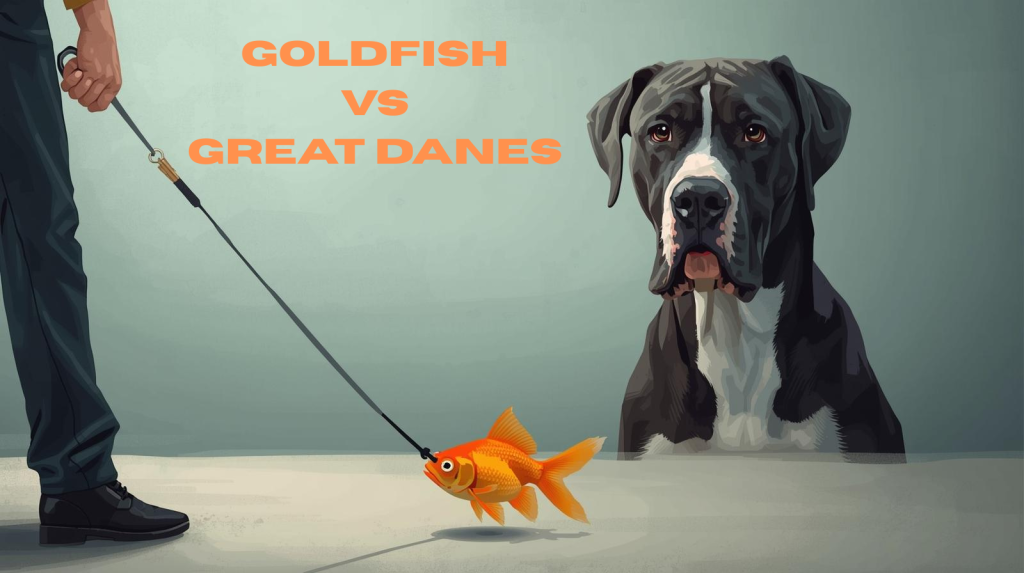

Managing residential vs. commercial properties is like comparing goldfish to Great Danes. They both need care, but try walking one on a leash.

Residential and commercial management might share a few basics — collect rent, maintain property, communicate — but that’s where the similarities end.

Commercial management deals with complex leases, longer tenant lifecycles, and customized maintenance schedules tied to business operations. You need a specialist who speaks fluent “lease clause” and understands that downtime means lost revenue. Residential know-how won’t cut it when your tenant’s business depends on every open hour.

That’s why specialization matters: a manager who understands build-outs, CAM reconciliations, and zoning nuances will protect your investment more effectively than a generalist ever could. That’s why Level Property Management Group has a commercial management division with different property managers and different teams.

2. How does professional management increase ROI on commercial properties?

Think of professional management as your investment’s personal trainer — minus the yelling. Professional management turns property ownership from reactive to strategic. Instead of waiting for issues to appear, a management team proactively prevents them — from tenant retention and maintenance planning to financial forecasting and rent optimization.

Level Property Management Group uses data-driven systems to track expenses, monitor market shifts, and identify profit leaks. A property managed well can command higher rents, experience less downtime, and build long-term asset value. In other words, ROI isn’t just a number — it’s a reflection of consistency, care, and local expertise.

The result? Less stress, fewer surprises, and a healthier ROI you can actually brag about at dinner.

3. What makes Level Property Management Group different from corporate firms?

Corporate firms often chase volume; Level chases value.

Because Level PMG is local, every decision — from contractor selection to tenant vetting — is made with Baldwin County insight. There’s no out-of-state call center or cookie-cutter solutions.

Clients get a full team with the technology of a large firm but the heart of a family business that’s been in local real estate for decades. That means faster response times, transparent communication, and long-term relationships instead of transactions.

4. How do you find and keep quality commercial tenants?

Finding great tenants is a bit like dating — everyone looks good on paper, but you need to know what you’re really getting. Finding good tenants starts long before a lease is signed. Level PMG’s team screens thoroughly — not just for credit or background but for compatibility and stability.

But retention is where ROI really grows. Regular communication, quick maintenance response, and fair market pricing build tenant trust. Happy tenants renew leases, take care of spaces, and treat your property like their own. The secret to high ROI isn’t turnover — it’s tenure.

5. What makes a great commercial tenant?

A great tenant doesn’t just pay on time — they align with the property’s purpose.

In retail centers, that means businesses that complement each other. In office spaces, it’s reliable, stable operations that maintain traffic and consistency.

Level PMG evaluates potential tenants on longevity, reputation, and financial soundness. The goal isn’t to fill a space quickly — it’s to fill it wisely, with tenants who strengthen the asset and enhance long-term ROI. We match the right tenant to the right property — like a professional matchmaker with spreadsheets. Because when your tenants succeed, so does your investment.

6. Why does communication matter so much in commercial property management?

Commercial properties live and die by communication. Owners need real-time financials; tenants need fast maintenance responses; vendors need clear direction.

Without it, costs rise and relationships crumble. Level PMG’s technology platform ensures everyone stays informed — transparent statements, maintenance updates, and proactive check-ins.

Our systems keep everyone in sync, and our team actually answers the phone. Revolutionary, right? Good communication doesn’t just solve problems faster — it prevents them entirely.

7. What are the 3 biggest mistakes commercial property owners make?

- Underestimating operating costs. Ignoring capital reserves or deferred maintenance erodes returns fast.

- Managing reactively. Waiting until something breaks — a roof, a lease, or a relationship — costs more than proactive planning.

- Flying solo. Managing commercial property alone is like DIY electrical work — impressive until it sparks.

Level PMG prevents all three by combining financial discipline, local insight, and preventive maintenance that keeps value growing year after year.

A Final Word

Property management doesn’t have to be complicated or corporate. It can be personal, purposeful, and yes — even pleasant.

At Level Property Management Group, we bring faith, local expertise, and technology together to make ownership easier, smarter, and more rewarding.

If you’re ready to stop juggling and start growing, we’re just a call away at 251-210-1664.

After all, it’s called Level for a reason.