When it comes to owning or investing in multi-family properties, the difference between profit and headache often lies in how your property is managed. Too many apartment managers fall into the “rent collector” trap—showing up for the checks and emergencies, but not treating the property like a real business.

But a property is a business. And when it’s managed like one, it can generate consistent cash flow, steady appreciation, and satisfied tenants who stay longer.

So how do you know if your apartment manager is running your property like a business—or just coasting along? Let’s break it down.

1. Do They Track and Report Key Metrics?

Rent collection is just the baseline. A professional apartment manager provides monthly financial statements, occupancy reports, maintenance logs, and expense tracking.

Business-minded managers: Provide clear reporting, highlight trends (like rising maintenance costs), and give you insights for smarter decisions.

Rent collectors: Hand you a check and hope you don’t ask questions.

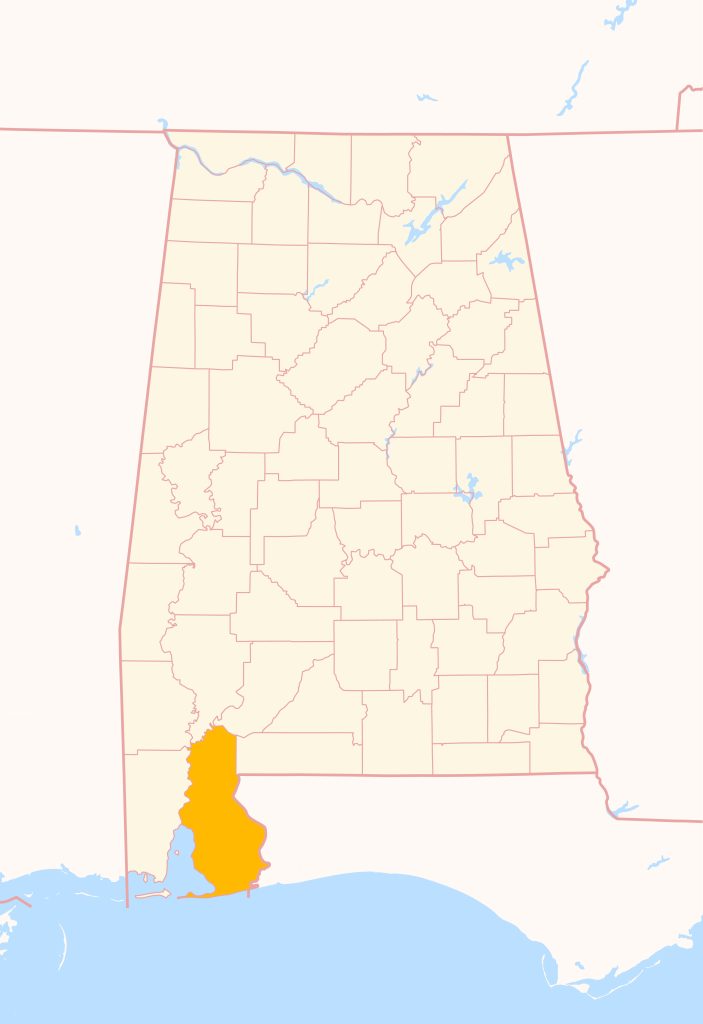

In Baldwin and Mobile Counties, where rental competition is heating up, tracking metrics like tenant turnover rates, per-unit expenses, and revenue per square foot can mean the difference between outperforming the market and falling behind.

2. Are They Focused on Tenant Retention—Or Just Filling Vacancies?

Keeping good tenants is one of the fastest ways to maximize ROI in multi-family investments.

Business-minded managers: Screen tenants thoroughly, respond quickly to service requests, and invest in preventative maintenance. They know tenant experience directly impacts your bottom line.

Rent collectors: Focus only on filling units fast, often overlooking long-term satisfaction.

Every turnover can cost thousands in lost rent, cleaning, marketing, and concessions. If your manager isn’t paying attention to tenant retention, you’re losing money.

3. Do They Proactively Protect Your Property Value?

A true apartment manager acts as a steward of your investment.

Business-minded managers: Schedule regular inspections, budget for capital improvements, and bring you proactive recommendations that protect and grow property value.

Rent collectors: Call you when something breaks—and usually when it’s already too late.

In our coastal Alabama market, where humidity, storms, and salt air can wreak havoc, proactive maintenance is more than nice—it’s necessary to keep properties profitable.

4. Do They Understand Local Market Dynamics?

Running apartments successfully in Baldwin and Mobile Counties means staying in tune with local rental demand, seasonal leasing trends, and shifting regulations.

Business-minded managers: Bring you data-driven strategies, competitive rent pricing, and local expertise that aligns with your investment goals.

Rent collectors: Simply set the rent and hope tenants sign.

When you partner with a management team who lives and works locally, you benefit from knowledge that outsiders miss—like which neighborhoods are attracting the fastest growth or how to market to renters moving from Mobile to Baldwin County.

Final Takeaway: Rent Collectors Cost You Money

If your apartment or multi-family property manager isn’t:

- Tracking and reporting financials

- Building tenant loyalty

- Protecting property value

- Using local expertise

…then they’re not running a business. They’re just collecting rent.

At Level Property Management Group, we do more than rent collection—we run your property like the business it is. That means maximizing revenue, minimizing expenses, protecting your assets, and keeping your tenants happy.

Because when your property manager thinks like a business owner, your property performs like an investment.

Ready to see the difference? Let’s talk about how Level PMG can help your multi-family investment thrive in Baldwin and Mobile Counties.