Insider Tips from Baldwin County’s Trusted Commercial Property Managers

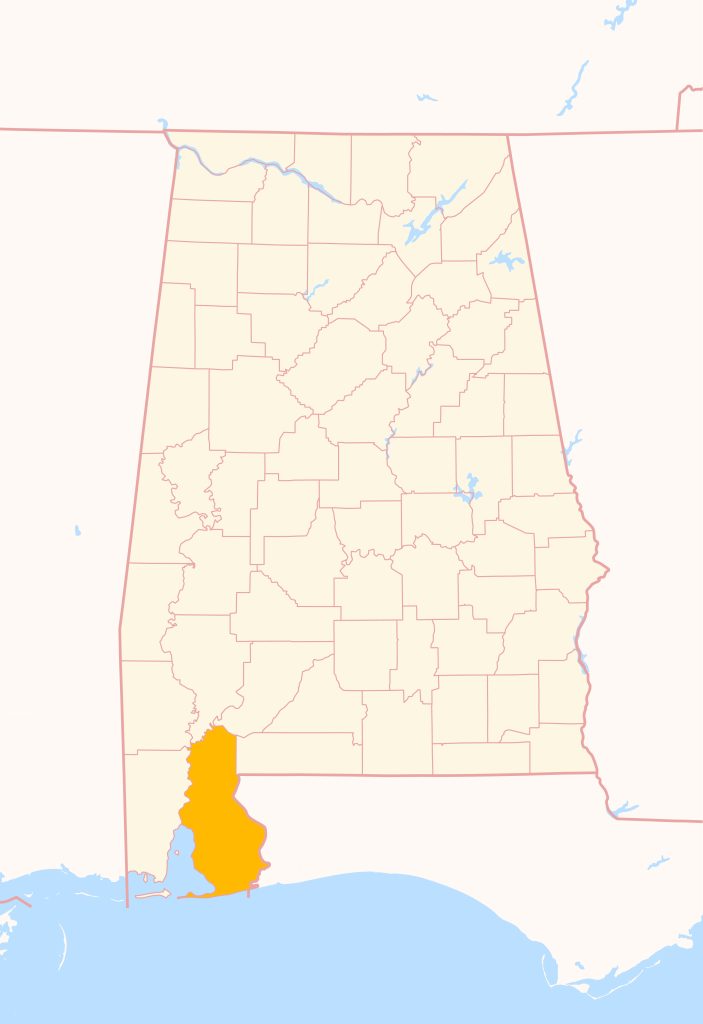

If you own commercial property in Baldwin County or Mobile, AL, you’re sitting on serious income potential—but only if you’re managing it like a pro. At Level Property Management Group, we’ve spent decades helping owners unlock hidden profits by tracking three core metrics.

This isn’t just theory—it’s what the most profitable property owners in our market actually do to stay ahead.

1. Occupancy Rate vs. Vacancy Cost

Insider Insight: Vacancy is more expensive than you think.

Many owners look at occupancy percentage and pat themselves on the back. But the most successful investors go deeper and track the cost of every vacant day. If you’re not analyzing the actual vacancy cost in your P&L, you’re missing hidden losses.

Behind the curtain:

In Gulf Shores, we’ve seen vacancy costs (not including loss of rent revenue) reach over $1,000 per month per unit, especially in retail strips with higher utility and security expenses. What’s more, properties that sit empty longer tend to attract less desirable tenants—a cycle that’s hard to break without help.

Leasing Tip:

Savvy owners are staggering lease terms and offering small buildout incentives to reduce downtime.

2. Tenant Retention Rate

Insider Insight: A happy tenant is worth their weight in rent.

A well-placed tenant in Foley or Downtown Fairhope can stay for 5–10 years—if managed right. Owners who spend just a little time tracking renewal data and improving communication enjoy stronger cash flow and fewer headaches.

What we see in the field:

In Loxley and Fairhope, we’ve heard about tenants moving out over unanswered maintenance requests or unclear lease renewal terms—both preventable. Owners working with a management company like Level Property Management Group often retain 85% or more of tenants year-over-year.

Local Power Move:

Top owners (or their management companies) send out annual satisfaction surveys and use that feedback to make small but impactful improvements—like better parking lot lighting or more frequent HVAC checks.

3. Net Operating Income (NOI) per Square Foot

Insider Insight: This is the ultimate profitability checkpoint.

NOI per square foot gives you apples-to-apples data across properties and units. It shows you where you’re winning—and where you’re bleeding cash.

Real-world example:

One owner in Daphne was losing money on what seemed like a great office building—until we calculated NOI per square foot. Turns out a back-corner suite with chronic turnover and high utility usage was quietly draining profit. A reconfiguration and new long-term tenant turned the entire building’s performance around.

Regional Reality:

In Baldwin County, office and medical space generally outperforms small retail in NOI/sqft, especially near growth corridors like Highway 181 and 59. But only if operating expenses are watched like a hawk.

Want to Maximize Your Property’s Earnings?

Tracking the right numbers separates high earners from frustrated landlords. And if it feels like a lot to handle, you’re not alone—many of our clients started out feeling overwhelmed too.

At Level Property Management Group, we specialize in commercial property management in Baldwin County, Alabama—and we’re here to help you make every square foot count.

Let’s talk strategy. Whether you own a strip mall in Daphne, a medical office in Mobile, or an industrial property in Robertsdale, we’ll show you exactly how to turn data into more dollars.