If you’ve been waiting for the “right moment” to buy, October could be it. National experts are pointing to mid-October as the most buyer-friendly window of the year.

Realtor.com explains: “By mid-October, buyers across much of the country may finally find the combination of inventory, pricing, and negotiating power they’ve been waiting for …”

That means October often delivers:

- More homes to choose from

- Fewer competing buyers

- More time to shop deliberately

- Better price flexibility

- Sellers who are more willing to negotiate

For real estate investors, timing, leverage, and strategy matter even more than for owner-occupant buyers. If you’re shopping to grow a rental portfolio in Baldwin County, October presents good investment opportunities — lower competition, more inventory, better negotiating power — all while interest rates ease.

But every market is different — so let’s look at what’s happening here in Baldwin County.

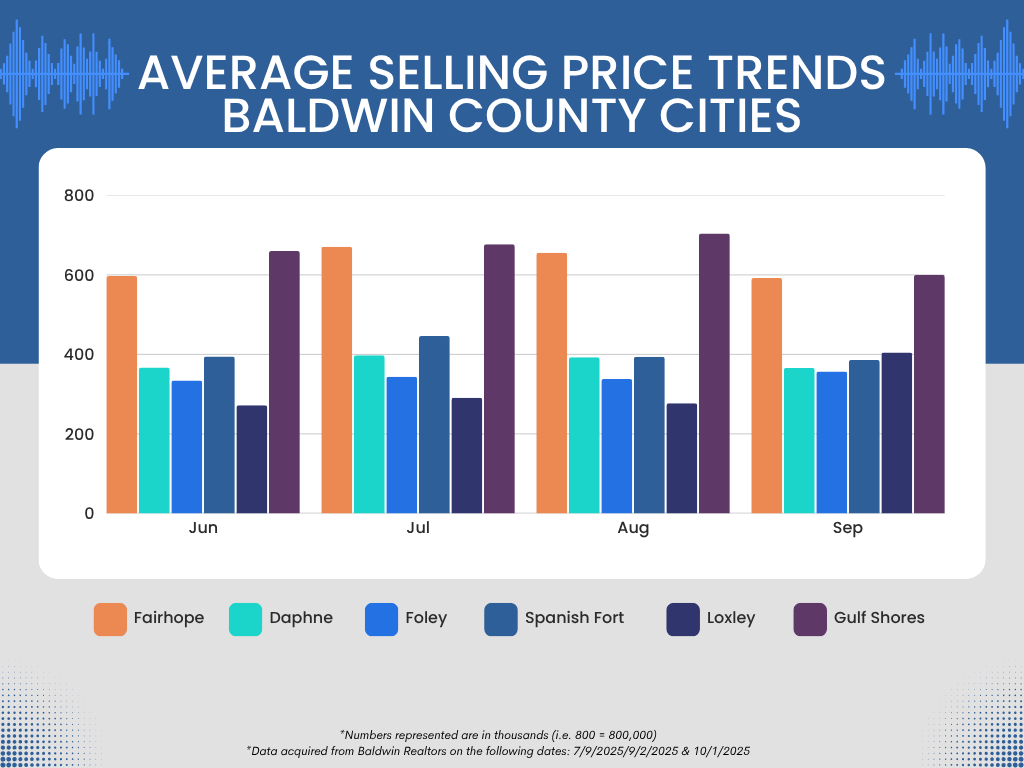

Baldwin County Market Snapshot — August & September 2025

The latest Baldwin Realtors® data shows some important late-summer shifts:

- Fairhope: Average selling prices stayed high through summer, hovering near $650K in July–August before dipping closer to $600K in September.

- Daphne: Held steady in the $360K–$390K range, with a slight softening in September.

- Foley: Mid-range prices between $370K–$400K, but stood out with the strongest September activity, closing 104 homes — the highest among Baldwin County cities.

- Spanish Fort: Remains one of the most affordable options, with average prices just above $300K and a steady pace of sales.

- Gulf Shores: Peaked above $680K in August before sliding closer to $600K in September — still among the priciest and most competitive coastal markets.

Mortgage Rates — September’s Surprise Dip

One more reason October looks promising: mortgage rates finally dipped in September.

- The Federal Reserve cut rates in mid-September, and 30-year fixed mortgages fell to around 6.4% — the lowest level of 2025 so far.

- Analysts expect rates could drift slightly lower toward the low-6’s by year-end, with the potential to drop below 6% in 2026.

This means Baldwin County buyers are entering fall with the best borrowing conditions of the year.

Perfect Timing : Winter is Your Secret Weapon

A big difference for investors: you’re not just grabbing a home — you often need to rehab, improve, and position the asset before leasing or resale.

Use winter (off-peak season) to your advantage:

- Contractor availability & pricing: During slower months, contractors may have capacity and offer lower rates.

- Lead time for permits and work: Use winter to permit, repair, upgrade, paint, etc., so your property is market-ready by spring or summer.

- Less disruption, more flexibility: Because fewer buyers are shopping in winter, you can schedule work with more breathing room.

This prep sets you up to list (or lease) in the spring, when buyer/renter demand and activity are strongest.

The Best Time to Sell? Spring Still Wins for Traditional Sales

If you ever plan to offload a property via a traditional sale, the spring/early summer window is still powerful:

- Realtor.com’s research shows that the week of April 13–19 tends to produce premium listing performance (more views, higher prices). (Realtor)

- Real estate seasonality is real: April through June is peak season for buyer activity, shorter days on market, and greater price competition. (Nar Realtor)

- By preparing your property over the winter (landscaping, curb appeal, minor renovations), you can hit the spring listing window with confidence.

So your sell strategy could be:

- Acquire in October

- Use winter to rehab / prep

- List in spring for top dollar

Final Takeaway

For investors, the playbook is clear: buy now while conditions favor you, improve properties smartly over the winter, and position them to lease or sell during the spring surge.

Level Up – Our Real Estate Investment Experts Can Help

At Level Property Management, our expert real estate advisors are here to:

- Help you find and evaluate new investment properties in Baldwin County.

- Analyze rental ROI so you know exactly how each property could perform.

- Recommend strategic improvements to make your units more attractive to tenants.

- Evaluate your current portfolio to identify properties worth holding, upgrading, or getting ready to sell in spring.

Whether you’re adding to your portfolio or preparing for a profitable exit, we’ll help you maximize returns every step of the way.